Our group is prepared to find out about your small business and information you to the proper solution. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with actual, skilled human support. For instance, the Inner Revenue Service (IRS) has particular guidelines for partnerships. Partnerships usually want to use the bulk curiosity tax year of their partners. These articles and associated content material is the property of The Sage Group plc or its contractors or its licensors (“Sage”). Please don’t copy, reproduce, modify, distribute or disburse without categorical consent from Sage.These articles and associated content material is supplied as a general guidance for informational functions only.

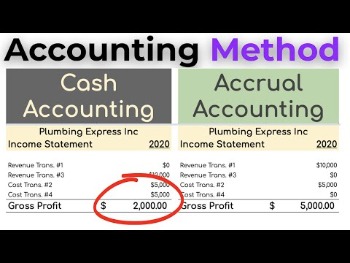

Under the accrual technique, the $5,000 is recorded as income as of the day the sale was made, although you may obtain the money a couple of days, weeks, and even months later. If you promote $5,000 worth of machinery, under the cash technique, that amount just isn’t recorded in the books till the shopper palms you the cash otherwise you receive the verify. On the flip facet, you also get to recognize all of your accrued expenses (accounts payable), which helps offset some of that new earnings.

Can You Utilize Each Cash And Accrual Accounting?

Accrual basis accounting records transactions as they happen, no matter when fee is received or made. Money basis accounting, however, only information transactions when cash is received or paid out. In accrual basis accounting, when a sale is made, the revenue is acknowledged and recorded on the earnings statement, no matter whether cost has been obtained. This is as a end result of the income has been earned and the enterprise is entitled to it. Similarly, expenses are recognized and recorded when they’re incurred, no matter whether or not fee has been made or not.

Utilizing the money method for income taxes is popular with companies for 2 main reasons. First, the tactic of accounting easily permits companies to reply questions relating to annual revenue, expenses and financial losses. And for companies that target inward money flow, it is simpler to align earnings with necessary dates, making it simpler to pay taxes on time. Think About a landscaping business completed a $10,000 job through the latter part of December. On a money basis, this is revenue assertion and is not acknowledged till the shopper pays their invoice the following January.

Companies that carry inventory as part of their operations could select a hybrid or accrual system. Alternatively, giant businesses typically use accrual foundation accounting to trace earnings and other financial metrics extra accurately. Small companies that are expected to grow can also want to start with accrual basis accounting so they’re ready for future accounting wants. If you haven’t paid a supplier’s invoice but, you do not have an expense. It’s this easy method that makes it the go-to alternative for freelancers, sole proprietors, and small companies with very simple operations. You don’t get slowed down tracking accounts receivable https://www.simple-accounting.org/ (who owes you) or accounts payable (who you owe).

- For instance, if you have $50,000 in outstanding invoices, that money could be counted as income immediately.

- These articles and related content material is not a substitute for the steering of a lawyer (and particularly for questions associated to GDPR), tax, or compliance professional.

- In accrual basis accounting, when a sale is made, the revenue is recognized and recorded on the income assertion, regardless of whether fee has been received.

- Cash-basis accounting is also referred to as money receipts and disbursements or the money methodology of accounting.

Since this will get sophisticated fast, speaking to a CPA before you resolve to switch isn’t only a good idea—it’s important. The IRS sees this as a formal change and requires you to file Type 3115, Utility for Change in Accounting Technique. This form is not any stroll within the park; most business homeowners get help from a tax professional to get it proper. This desk clearly shows that whereas the cash impression is identical, the accrual methodology provides a much more correct picture of Q1 profitability and the assets earned throughout that period. Think About a small consulting agency lands and completes a project in the first quarter (Q1). They bill their consumer for $10,000 in March however don’t actually get paid until April, which is in Q2.

Accounting For Enterprise

Switching your accounting method positively has tax penalties, which is strictly why the IRS is so concerned. The primary difference boils right down to the timing of when you acknowledge revenue and bills. This assertion tracks the actual money transferring in and out of your small business, plain and easy. To actually get a handle on the differences between these two strategies, it helps to see them side-by-side. Cash basis accounting supplies a transparent view of precise money available, which is efficacious for daily money circulate administration. As your small business grows, the accrual technique provides you a extra correct view of your finances.

When it’s time to decide on an accounting technique, small enterprise owners are faced with two approaches — cash-basis or accrual-basis accounting. Here’s a look at how they work, their advantages and drawbacks, and tips on how to select the right one for your business. In contrast to the businesses listed above, envision a growing company with inventory, credit sales, and a desire to secure funding for expansion. They need an accounting method that provides a comprehensive and accurate view of their financial performance, which is where accrual accounting comes in.

We collaborate with business-to-business vendors, connecting them with potential consumers. In some instances, we earn commissions when sales are made via our referrals. These financial relationships support our content material but do not dictate our suggestions. Our editorial staff independently evaluates merchandise based on hundreds of hours of research. Please read our review for extra data on QuickBooks Online and our ratings for other top accounting software.

It exhibits that the corporate has future cash flow on the method in which, an important piece of information the cash foundation methodology utterly ignores. If you need a deeper dive into building these stories accurately, our information on tips on how to put together monetary statements is a superb useful resource. Deciding whether or not to make use of cash basis accounting really boils down to your corporation’s dimension, complexity, and future targets. Whereas it’s a perfect slot in some scenarios, it can turn out to be an actual handicap as a business starts to develop.

Your choice between cash and accrual accounting impacts your taxes, business choices, and every day operations. The right technique is dependent upon your business measurement, business, and authorized requirements. So now you understand the difference between cash basis versus accrual accounting, it ought to be a bit clearer for you as to which accounting methodology you must use for your corporation. To use money basis accounting, you need to inform HMRC in your Self Evaluation tax return. Another limitation of cash foundation accounting is that it does not conform to Generally Accepted Accounting Principles (GAAP) or International Monetary Reporting Requirements (IFRS). This signifies that a enterprise using money foundation accounting might not have the flexibility to produce monetary statements which are comparable to different businesses.