With Enhanced Payroll, your confidence in handling tax issues grows leaps and bounds. It Is like having a roadmap via the advanced landscape of tax compliance, where every little thing is clearly signposted and straightforward to observe. These reports not only maintain you compliant, but in addition they supply a story of how a business is doing, complete with all the plot twists and turns you would possibly expect in a best-seller. With the use of the Enhanced Payroll device, reporting and monitoring task similar to exporting reviews to tax liabilities and period comparability has turn out to be easier. The Forbes Advisor Small Enterprise group is committed to offering unbiased rankings and knowledge with full editorial independence. We use product data, strategic methodologies and professional insights to inform all of our content to guide you in making the most effective decisions for your business journey.

I am not picking up anymore payroll shoppers that don’t have their very own subscription from here on out. The full-service package offers us with essential instruments which you need to operate varied necessary operations. In case you want to enhance business efficiency and you don’t have a good price range then you can get access to QuickBooks Enterprise Diamond.

Features include computerized tax calculations ensuring compliance with local, state, and federal tax legal guidelines, which is essential for accountants managing multiple clients. The platform also options customizable payroll reviews, which assist in making knowledgeable business decisions. Moreover, the integration of time and attendance monitoring helps ensure correct payroll processing, which reduces errors and saves time. BrightPay is a desktop and cloud-enabled payroll software designed for accountants, bureaus, and UK-based companies.

Qb Desktop Enhanced Payroll

Optimize inventory, streamline production workflows, and scale back errors with real-time data and mobile solutions, enhancing effectivity and boosting profitability. Please learn this Disclaimer carefully earlier than using the Accountinghelpline.com Web Site, because it accommodates essential information concerning the constraints of our liability. Your access to and use of the Website is conditional upon your acceptance of and compliance with this Disclaimer.

Quickbooks On-line Payroll

She makes a speciality of unblocking production pipelines, aligning stakeholders, and scaling content material delivery through systematic processes and AI-driven experimentation. Entry on-demand specialists to simplify payday and protect what issues most. Imagine all the time you can reclaim for extra strategic tasks when tedious entry work is lifted off your shoulders. Automation impacts your bottom line positively by lowering the risk of human error, which might lead to costly corrections. Edward Martin is a Technical Content Material Writer for our main Accounting agency.

You just want access to the identical desktop-based payroll software, which you should use https://www.intuit-payroll.org/ to enter the common and extra time hours of your staff. QuickBooks will care for all the tax payments and tax kind submissions which includes the reports of the tip year. It is very important for small enterprise house owners who need to outsource payroll tax administration.

Resolving W2 Computerized Submitting Discrepancy In Quickbooks: Handbook Print Required Per Settings

When you may have up to date the service key, use this to reactivate the payroll service that comes with the purchased QBDT. We used this method lately with a shopper on an older version of QuickBooks so after we acquired the file we transformed it to model 2005 and entered the key code to do our work. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 data with the IRS, after which print and mail a copy directly to your distributors and contractors (excluding corrections). As a part of the 1099 E-File Service, we also give your distributors and contractors online access to their 1099s.

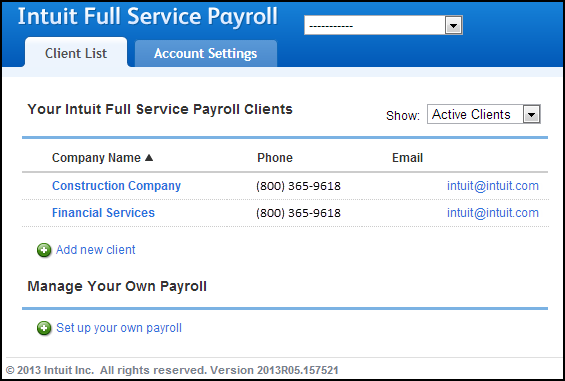

Many platforms present a central dashboard to handle all of your clients in a single place. You can quickly toggle between companies, run payroll for each, and entry separate reporting and compliance info, so you don’t risk mixing up accounts or consumer data. Pricing for payroll software program for accountants varies depending on the options, scalability, and level of assist required.

- With so many platforms providing overlapping features, from small-business necessities to enterprise-grade instruments, choosing the right solution can really feel overwhelming.

- Accountants understand how essential it is to maintain their shoppers happy, which also means keeping their clients’ staff happy.

- Streamlines order success, automates inventory tracking, and ensures efficient delivery management, serving to businesses optimize logistics and improve buyer satisfaction.

- At this time, you might contact our Sales Division to enable them to offer you in-depth choices that would cater to your wants.

The platform additionally provides flexible payment choices, corresponding to direct deposit, pay cards, and verify printing, which cater to various employee preferences. Moreover, Paychex supplies comprehensive HR companies, including benefits administration and compliance help, which assist businesses manage more than just payroll. Options embrace tax calculations and filings, lowering the chance of errors and guaranteeing compliance. The service includes a time tracking function, which integrates instantly with payroll to streamline the payment process based mostly on precise hours worked.

In addition, customers can create custom report groups for every client, running reports after every payroll, or offering entry to purchasers to run stories when needed. Each shopper arrange in Intuit Online Payroll has access to the consumer portal, which can be custom branded with the firm’s emblem and other advertising details. Fashionable payroll tools offer you extra than just automation—they unlock advisory opportunities.

For accountants, BrightPay Connect—its cloud add-on—adds remote access, online backups, and employee self-service options, permitting staff to view payslips, submit depart requests, and access documents online. Sage for Accountants is designed to assist accounting professionals with payroll administration capabilities and enhanced collaborative features. It allows efficient handling of payroll processes whereas offering comprehensive tools to facilitate teamwork amongst accounting teams. Features embrace comprehensive payroll providers like the ability to pay teams on time with one click, deal with taxes, and supply benefits and payslips. Deel also helps world hiring with in-house visa assist and the creation of compliant contracts, making it easier for companies to hire and handle employees and contractors across different nations. Most companies are best served by Wave’s Pro plan, which prices $16 a month and consists of digital receipt seize, message templates and the flexibility to attach files to invoices and estimates.